|

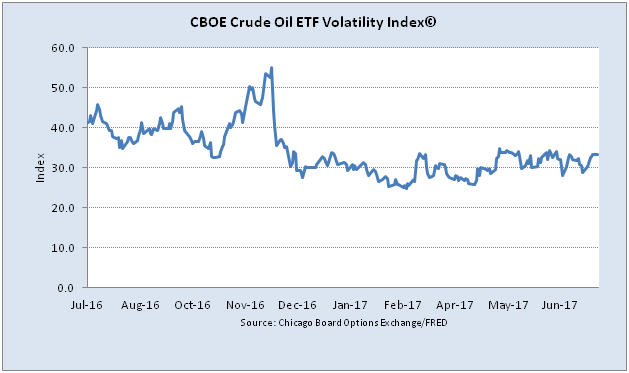

Will this low volatility persist and can a large market decline happen in this environment? Aaron Brown recently published an article in which he pointed out that a large jump in realized volatility happens only when the VIX is above 20. ...the important thing is that there aren’t big surprises at low levels of the VIX. Realized volatility has never been above 20 percent starting from a VIX that is under 12 percent. And the really high realized volatilities are almost all starting from when the VIX is above 20 percent. This is consistent with our own studies. We observed that a large decline in the stock market happened only when the SP500 is below its 200-days moving average. In the past, there was only 1 instance when this was not true.

A. Brown concluded: ... both realized volatility and the VIX are at low levels, but not unprecedentedly low levels. Looking at what happened in the past starting from these VIX levels, it seems unlikely that we’ll get realized volatility above 20 percent at least over the next month. I’m not claiming a switch to a period of high volatility or a stock market crash is impossible. I’m saying that the evidence provides an argument that dramatic moves are unlikely anytime soon rather than a warning sign of an impending crisis. Read more From a qualitative point of view, Schroders chief economist and strategist Keith Wade thinks that this low volatility environment can persist for some time to come. He pointed out 3 main reasons for the subdued level of volatility:

The economist also noted: The next shock to markets may not be driven by the Fed, oil or China. It could be geopolitical in origin, for while political risks may have eased in Europe they are building in Asia where tensions between the US and China will rise if North Korea does not ease back on its nuclear weapons programme In summary, this low level of volatility can last for a while. And be careful when the VIX goes above 20.

Originally Published Here: How Long Will Low Volatility Last?

0 Comments

Leave a Reply. |

Archives

April 2023

|

RSS Feed

RSS Feed