|

If you want to invest in something, you should not only think about the rate of return. It is better to also think about the risk. The risk can be high or low. It refers to how different an asset's or security's financial performance will be than what is expected. Unfortunately, many performance metrics do not account for the variation in risk of investing. They calculate how much money they will make. But when it comes to the Sortino ratio, it has a different way that it is calculated. The indicator is looking at changes in the risk-free rate. That way, investors can make better-informed decisions. It becomes really helpful because it helps investors to reduce the risk. In this article, we are going to look at what the Sortino ratio is, how it works and why it is different from other performance measures. What is the Sortino RatioThe term "Sortino" was named after Frank Sortino, who was a former head of the Quantitative research group at Bell Investment. He was a pioneer in promoting a risk-adjusted return. So what is this ratio The Sortino ratio is different from other ratios because it focuses on downside risk instead of the overall return. It measures how well the investment does in regards to the risks that are involved. That makes it a valuable tool for investors who want to reduce risk in their portfolios. The formula for the Sortino ratio is as follows Sortino Ratio = (Average Realized Return - Expected rate of Return) / Downside Risk How does the Sortino Ratio workTo calculate the Sortino ratio, you will need to know what is called the downside deviation. This is how much an investment will vary from its expected value regarding risk. It can be expressed as a negative number. The downside deviation is not always possible to know exactly because it will require having specific market data at hand. It is also difficult to measure because there are many different ways that it can be presented over a certain period. What the Sortino Ratio does is to decrease this downside deviation by focusing on high, positive returns. That way, you will get a ratio that is increasing whenever a portfolio's performance actions move more advantageously. What makes the Sortino Ratio different from other ratiosSome factors make the Sortino ratio different from other performance measures. The first is that it reduces the effects of volatility on returns. The traditional way of measuring an investment's success was to look at its return over a certain year, which can be misleading because there can be negative returns. But by subtracting this downside risk and focusing on positive returns, the investor can get a more accurate picture. Another thing is that it helps in identifying periods when investments are doing well regarding risk. This gives investors an idea of when they will need to reduce risk in their portfolios or limit losses. It also shows you what impact different market conditions have on your portfolio's performance. The last factor is that it has a great way of benchmarking. It can compare how well an investment or portfolio is doing against another that uses different return and risk criteria. Why use the Sortino RatioThere are several reasons why you should think about using the Sortino ratio for your investments. Here are they:

The Sortino ratio is a great way to compare an investment's return and its downside risks. That makes it easier to determine whether the investment is good for you or not.

It will help you make important decisions about your portfolio, such as switching out investments that are bad performers. It will also help you make other certain adjustments to make sure that your portfolio can improve its overall performance.

The Sortino ratio is especially useful for investors who want to compare different types of investment portfolios with each other. You can use it as an initial step when investing and it will help you know what kind of risks the investment is involved in. ConclusionThe Sortino ratio provides investors with a more accurate way of measuring investment performance. It helps in assessing how well an investment is doing regarding its risk factors and it can be very useful when making other decisions about your portfolio. Article Source Here: What is the Sortino Ratio

0 Comments

The liquidity of a stock is of concern to traders who want to execute a large order at reasonable prices without making a big impact on the market. A stock liquidity level is, however, also a factor influencing the stock expected return. Along this line, Reference [1] examined how a stock’s liquidity volatility affects its future performance. Chordia et al. (2001) find an interesting and puzzling result that the volatility of turnover ratio is negatively related to subsequent stock returns in the U.S. market. We extend the analysis to 43 global equity markets, and test this liquidity-volatility-return relationship using not only the turnover ratio but also other liquidity measures such as the Amihud illiquidity ratio and the percentage of zero-return days. We find that the negative premium of liquidity volatility is not limited to the U.S. market or a particular liquidity measure. Instead, it is robust in the majority of global equity markets and across different liquidity measures, and holds up to the inclusion of additional controls such as the idiosyncratic return volatility. In other words, the article pointed out that the negative volatility premium is a universal phenomenon that occurs in the majority of global equity markets and across different liquidity measures. Practically speaking, when a stock's liquidity decreases, it will likely decline in the following months. Consistent with the literature, we show that liquidity decrease has much stronger impact on the next-month stock returns than liquidity increase, because of the collateral-constraint effect as proposed by Brunnermeier and Pedersen (2009) and others. Hence, for a stock with high liquidity volatility, it is more likely to have a large price decline following a large magnitude of liquidity decrease, and such large price decline cannot be fully offset by the price appreciation even following the same magnitude of liquidity increase because of the asymmetric pattern mentioned above. In summary, a stock's liquidity is important not only because of the issues associated with the order execution but also because it affects the future performance of the stock. Therefore, fund managers should take liquidity into consideration when constructing investment portfolios. References [1] Feng, Frank Yulin and Kang, Wenjin and Zhang, Huiping, Liquidity Shocks and the Negative Premium of Liquidity Volatility Around the World (2021). https://ssrn.com/abstract=3930591 Post Source Here: How Liquidity of Stock Affects Its Future Expected Return An option is a contract that provides its holder with the right to buy or sell an underlying asset or security. It involves a specific price before or on a predetermined date. However, it does not obligate them to do so. There are several option styles, which represent the class into which an option falls. Usually, the dates on which holders can exercise the option define its style. The most prevalent of these include American and European options. However, investors can also acquire less common exercise rights. One of these is the Bermudan option, which combines the characteristics of both of the above. What is a Bermudan Option?A Bermudan option is an option that gives the holder the right to exercise a set number of times. These options fall between European and American options. Usually, European options only allow the holder to exercise at the expiration date. On the other hand, American options provide the right to exercise at any time. Bermudan options do not have the right to exercise at expiration or any time. Instead, they allow holders to exercise several set dates. A Bermudan option differs from the traditional options and, therefore, falls under exotic options. It comes with predetermined dates, which are when the holder can exercise the option. Usually, these dates come after regular intervals, for example, on a specific day each month. Apart from this, Bermudan options have the same features as other options. Bermudan options allow investors to buy or sell an underlying asset or security at a preset price. However, it does not specify a single date or allow exercise at any time. Instead, it sets several dates along the expiration date to exercise. These exercise dates fall close to the option's expiration date. Due to these features, Bermudan options fall between American and European options. ExampleAn investor purchases a company's stocks for $100. However, they are unsure whether the stock's price will decrease in the future. Therefore, they acquire a Bermudan put option with an expiry of a year. This option protects the investor from a decrease in the stock's price below $95 for the year. Similarly, it contains a feature to exercise on the fifth of each month after the 8th month. The Bermudan option provides the investor with various benefits. Firstly, it allows them to stay protected against any price falling beneath $95. Similarly, it provides them with the opportunity to sell the stock at the exercise price on the fifth of each month. Regardless of how much the stock's worth will be at the time, investors can use the option to gain benefits. What is the pricing of Bermudan Options?The pricing of Bermudan options introduces various challenges. These challenges stem from the several set of dates that these options define. In this regard, Bermudan options are similar to American options. Unlike European options, both of these options pose challenges when it comes to pricing. However, several techniques can help determine the value of Bermudan options. Bermudan options can be valued by using the Binomial Tree approach. Analysts can also use a Monte-Carlo framework to value Bermudan options. However, it will not take the traditional approach to evaluate options that require the value of the options. Instead, it involves an optimal exercise strategy. There are several approaches that analysts can take when using Monte Carlo simulations for evaluating Bermudan options. One approach to pricing Bermudan options is the dynamic programming approach. With this approach, the option value for each set date becomes the maximum of the payoff associated with immediate exercise. This value is known as the intrinsic value. It also involves determining the continuation value, although this process is more challenging. ConclusionAn option provides the holder with the right to buy or sell an underlying asset or security at a specific price at or during a predetermined time. Bermudan options allow the holder to exercise on a set of specified dates, usually at regular intervals. The pricing of Bermudan options is a challenging process. There are several methods that analysts may use for this process. Post Source Here: Bermudan Option: Definition, Example, Pricing In the hedge fund industry, return over maximum drawdown is the best measure of how well the fund manager has managed risks. It measures the average return of a portfolio over its worst loss, or "maximum drawdown." This is a relatively new indicator for managers to track and compare since the industry only started tracking this statistic in the 1990s. The drawdown must be observed from the peak profit or peak value of equity. A drawback of the return over maximum drawdown metric is that it does not directly measure how profitable returns are, but rather measures how well a hedge fund has managed risks. So now let's find out what is "Return over Maximum Drawdown". What is the Return over Maximum DrawdownReturn over maximum drawdown is a risk metric used in the hedge fund industry, which measures how well the fund managers have managed risk. It measures the average return of an investment over its worst loss since the beginning of the period under consideration. The drawdown must be calculated from the peak value or peak profit. How to calculate the Return over Maximum DrawdownTo calculate the return over maximum drawdown, start by getting the average return on investment. Then, get its worst loss or maximum drawdown. Next, divide the two to find the return over maximum drawdown. The drawback to this measurement is that it only measures how well an investment manager has managed risks and does not directly measure how profitable returns are. For example, imagine that an investment has a -15% maximum drawdown and averages +25.2%. Return over maximum drawdown would be 25.2% /15% = 1.68 In this example, the return of investment is higher than its worst loss or maximum drawdown, which means it had a good risk management system compared to other investments. Benefits of Return over Maximum DrawdownThe main benefit of return over maximum drawdown is that it's a relatively new measure used in the hedge fund industry, which first started tracking this statistic in the 1990s. Many investors use the return over maximum drawdown to compare how different investment managers manage risks. Here are some benefits of Return over Maximum Drawdown:

Drawbacks of Return over Maximum DrawdownThere are some drawbacks of the Return over maximum drawdown

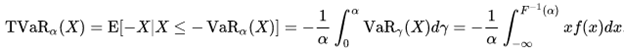

ConclusionReturn over maximum drawdown is a risk metric used in the hedge fund industry, which measures how well investment managers have managed risk. It measures the average return of an investment over its worst loss since the beginning of the period under consideration. The drawback to this measurement is that it only measures how well an investment manager has managed risk and does not directly measure how profitable returns are. Return over maximum drawdown can be used to compare investments and to measure performance, but it does not directly measure profitability. Originally Published Here: Return over Maximum Drawdown What is Econometrics?Econometrics is a field in economics that applies statistical and mathematical methods to economic theories. It has become more relevant over the years as it helps economists quantify their economic theories and hypotheses. Econometrics helps economists test those theories by using statistical tools with mathematical equations. Therefore, it has become a crucial part of economic policymaking. Econometrics usually involves establishing relationships between various economic variables. For that, economists use mathematical and statistical methods. Usually, economists must perform multiple calculations using complex models. Some economists use programming languages and other tools to expedite the process. These may include R, Python and MATLAB. What is “R”?"R" is a programming language that economists use for statistical computing and graphical representation. It offers an extensive list of statistical and graphical techniques. These include machine learning algorithms, time series, statistical inference, linear regression, etc. Furthermore, these are all tools that are an essential part of econometrics. Apart from econometrics, R is also prevalently used in other fields. R is one of the most popular languages used by statisticians, researchers, analysts, and economists. Through it, they can extract, filter, analyze, visualize and present the data. It is also free to use and open-source, making it more accessible. It is among the top ten popular programming languages in the world. R has existed since the ‘90s but has gained popularity recently for its extensive features and runtime environment. Base R contains a lot of functionality useful for econometrics, in particular in the stats package. In addition, there are many other econometrics packages available for free on the Internet. What is Python?Python is another powerful and high-level object-oriented programming language. It is the world’s most popular programming language. Like R, Python is also well-known among statisticians, economists, data scientists, and researchers. Similarly, most of the packages in R are available in Python as well, making it an all-in-one option for users. Apart from its usage for data processing, Python also has various other uses. Python has existed since the ‘80s. However, the language has gained popularity recently due to its extensive list of libraries and ease of use. Most programmers recommend it as the best language for beginners to get started. Like R, Python is also open-source, making it available to the public. Most large companies in the technology industry use Python, including Google, Microsoft, Reddit, Mozilla, etc. There exist many specialized libraries for performing econometrics studies in Python. Amongst them, Statsmodels is a frequently used package. What is MATLAB?MATLAB is a programming platform that focuses specifically on the needs of scientists, engineers, and data analysts. It allows users to make complex calculations, implement algorithms, create user interfaces, plot functions and data, and much more. It includes a vast library of mathematical functions for linear algebra, numerical integration, statistics, and differential equations. MATLAB has some pre-programmed procedures that can help economists with their research. On top of that, there is a wide variety of open-source code available from other users online that is available to the public. Although it may not be as fast as Python or R, it is still the most famous program among high-level econometricians. Similarly, unlike Python and R, MATLAB is neither free nor open-source. Econometrics studies can be performed by using the Econometrics Toolbox in Matlab. ConclusionEconometrics involves the use of statistical and mathematical methods to test economic theories. There are several tools or programming languages that can help econometricians. Usually, econometricians prefer R, Python, and MATLAB. All of these can help econometricians perform complex computations. Based on the needs and usage, each tool or language has its benefits and drawbacks. Article Source Here: Econometrics With R, Python and MATLAB The Tail Value at Risk (TVaR) is a financial measure of a potential loss in a portfolio. Tail Value at risk uses the same statistical principles as the traditional value at risk with the only difference being that it measures an expectation of the remaining potential loss given a probability level has occurred. Conceptually, tail value at risk is similar to Value-at-Risk (VaR), except it measures the maximum amount of loss that is anticipated with an investment portfolio over a specified period, with a degree of confidence In this article, we'll first look at the basic theory behind the value at risk, and then we will introduce tail value at risk. What is the Standard DeviationValue at Risk is the measure of the downside or risky part of an investment. To be more precise, it answers this question: "What is the potential loss in a portfolio?". To understand how Value at Risk works, we should first understand what a standard deviation is. The standard deviation is one of the most commonly used tools for measuring variability and dispersion of data. If you are not familiar with the concept of standard deviation, you may want to check out "Standard Deviation and Variance: Statistics for Stock Traders" first. Standard deviation can be used to measure both upside and downside variability in a portfolio. In order to get a better grip on this idea, let's look at a simple example below: Suppose that you have a well-diversified portfolio, which you are tracking on daily basis. For the sake of simplicity, let's assume that this portfolio has 10 securities in it. Daily returns are normally distributed with an average return of 0% and a standard deviation of 2%. So, one day you noticed that your overall return is -4%, instead of 0%. This is definitely not good news. You have a look at the largest losses for each of the 10 securities and you notice that some of them are making significant contributions to your loss. Next, you looked into historical data and noticed that the securities that made a negative contribution to your portfolio on that day also did so in 50% of all cases. In other words, they have a downside correlation of 50%. In order to assess the risk inherent in the portfolio going forward, you want to calculate how much money you may lose going forward. So now let's find out how to calculate Value at Risk of a portfolio. Calculating Value at RiskHere is how you calculate value at risk Value at Risk = [Expected Weighted Return of the Portfolio− (z-score of the confidence interval× standard deviation of the portfolio)] × portfolio value The standard deviation in portfolio returns is usually smaller than the individual securities' standard deviation since diversification helps to reduce dispersion. Also, you can expect that there will be more negative values than positive values in your tail distribution. This is because in reality the return distribution is not normally distributed (left-skewed). Calculating Tail Value at RiskNow, let’s examine what Tail Value at Risk is, There are a number of related, but subtly different, formulations for TVaR in the literature. A common case in literature is to define TVaR and average value at risk as the same measure. Under some formulations, it is only equivalent to expected shortfall when the underlying distribution function is continuous at VaR(X) the value at risk of level alpha. Under some other settings, TVaR is the conditional expectation of loss above a given value, whereas the expected shortfall is the product of this value with the probability of it occurring.The former definition may not be a coherent risk measure in general, however it is coherent if the underlying distribution is continuous. The latter definition is a coherent risk measure. TVaR accounts for the severity of the failure, not only the chance of failure. The TVaR is a measure of the expectation only in the tail of the distribution. Read more If X is the payoff of a portfolio that has f as the probability density function and F as the cumulative distribution function, then the left Tail Value at Risk can be expressed as follows, |

Archives

April 2023

|

RSS Feed

RSS Feed